Understanding the PrimeXBT Funding Rate A Comprehensive Guide

Understanding the PrimeXBT Funding Rate: A Comprehensive Guide

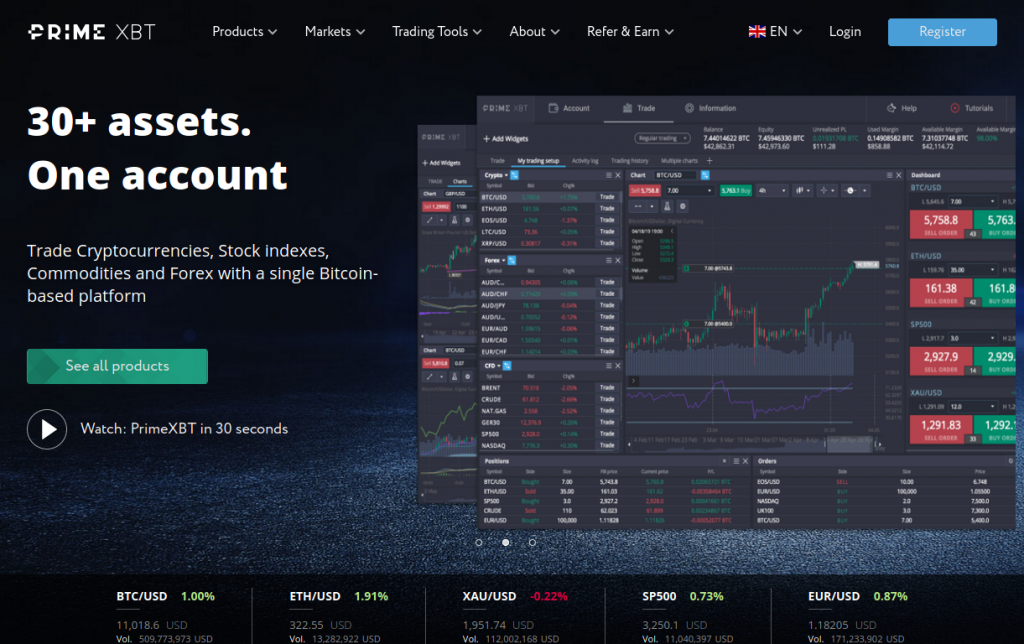

The world of cryptocurrency trading is fraught with complexities, not least of which is understanding the various mechanisms that influence the market. One such mechanism is the funding rate, particularly in platforms like PrimeXBT. The funding rate is a critical concept for traders using margin and derivatives, as it directly affects trading costs and profitability. This article delves into the PrimeXBT funding rate, exploring its implications, how it is calculated, and strategies for traders to adapt accordingly. Moreover, we’ll look into primexbt funding rate PrimeXBT fx trading strategies to enhance trading effectiveness.

What is the Funding Rate?

The funding rate is a periodic payment made between longs and shorts in the derivatives market. It is designed to ensure that the perpetual contracts price remains in line with the underlying asset’s price. Essentially, the funding rate serves as an incentive, encouraging one side of the trade to take positions that will influence the direction of market liquidity. Understanding how this rate works is critical for any trader aiming to leverage the full potential of platforms like PrimeXBT.

How is the Funding Rate Calculated?

The funding rate is typically determined by several key factors including:

- Interest Rate: This is one major component that considers the cost of capital for long and short positions.

- Mark Price: It reflects the fair value of the asset, factoring in overall market conditions and liquidity.

- Premium or Discount: This compares the perpetual contract price against the underlying asset to gauge market sentiment.

The actual calculation involves taking a weighted average of these factors over a specified period, with the resulting funding rate applied at regular intervals (e.g., every 8 hours) to long and short positions. If the funding rate is positive, longs pay shorts; if negative, shorts pay longs.

The Significance of the Funding Rate

The funding rate plays a pivotal role in various aspects of trading on PrimeXBT:

- Cost of Trades: Traders should factor in the funding rate when calculating potential profits and losses. A high funding rate can significantly reduce the viability of a long position.

- Market Sentiment Indicator: A persistently high funding rate may indicate market optimism, signaling traders to consider potential reversals.

- Risk Management: Understanding the funding rate allows traders to adjust their risk management strategies, potentially choosing to close positions before unfavorable funding rates take effect.

Strategies to Optimize Trading with the Funding Rate

The funding rate can be leveraged as part of a broader trading strategy. Here are some tips for optimizing your trading benefits while considering the funding rate:

- Be Aware of Market Cycles: Understanding whether you’re in a bullish or bearish market can help you make informed decisions regarding your positions. Always keep an eye on the funding rate trends.

- Short Positions During High Funding Rates: If the funding rate is consistently high, consider opening short positions. This not only gives you the chance to benefit from potential downtrends but also allows you to earn funding from longs.

- Manage Leverage Wisely: High leverage can amplify both gains and losses. Keep your leverage in check and always account for additional costs generated by the funding rate.

- Use Price Alerts: Set price alerts associated with funding rate changes. This helps you react quickly to market shifts, ensuring you can adjust your strategy in real-time.

- Engagement with Community Insights: The trading community often shares insights regarding funding trends and market sentiment. Engaging in forums and discussions can open up new strategies based on collective intelligence.

Conclusion

Understanding the PrimeXBT funding rate is paramount for trading effectively in the cryptocurrency derivatives market. By grasping how the funding rate is calculated and its implications, traders can create informed strategies that adapt to ever-changing market conditions. Whether entering long or short positions, being aware of funding rates can mean the difference between profit and loss in your trading activities. Implementing strategies that take into account funding dynamics will not only enhance trading results but also foster an insightful approach to the increasingly competitive landscape of cryptocurrency trading.